3rd Quarter 2019

Market Watch

by Joe A. Hollingsworth, Jr.

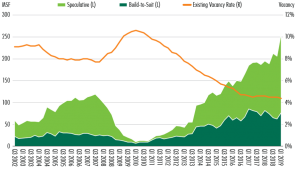

Those of us that have been in the industrial development business for several decades have really never seen a time when excess demand is repeatedly outstripping supply. The below chart highlights how radical this is. Our opinion is that the industrial sector of the economy is progressing very well. There are repeated naysayers, such as the nightly news highlighting everything that could possibly go wrong. However, the solid proof is still an expanding GDP that leads us to more aggressive positions when speculating on industrial real estate. Even with the surge of speculative activity and more than doubling of the build-to-suits, the vacancy rate is at an all-time low. However, this chart also begs for bifurcation of the market. New Jersey, Dallas, California, and Central Pennsylvania were some of the top industrial markets last year, accounting for over 34% of the total US absorption. While these areas will continue to grow, we think they will grow at a much more moderate rate; because, even higher paying companies cannot fill the minimal job needs for distribution in these locations. It is our opinion that a great deal of that demand for space has already begun to shift to tertiary cities that are interstate-connected where they can expect cheaper land, less taxes, less regulation, a chance at a TIF, and can find employees. Also, while you may have differences in logistical costs from the big distribution hubs, being able to operate at all without labor is impractical. In fact, we are seeing more projects use existing available labor pools as the driving reason, even over geography, for their next plant location.

Also, the chart highlights and brings forth the question of how much speculative is enough in these high-velocity logistical areas. We believe these tertiary markets have already begun to see the onshoring of all the early movers with tariff exposure. Available buildings outside of those areas mentoioned above are seeing a much higher proportion of manufacturing and value-added company visits versus logistics. The industrial developers that are working either on build-to- suits or existing space in these tertiary markets are getting cap rates that make all the REITs jealous.