Serving American industry since 1972

Building Success Through Industrial Development

Modern single-tenant industrial buildings across the southeast, tailored for manufacturing and logistics

Find Your Ideal Industrial Space

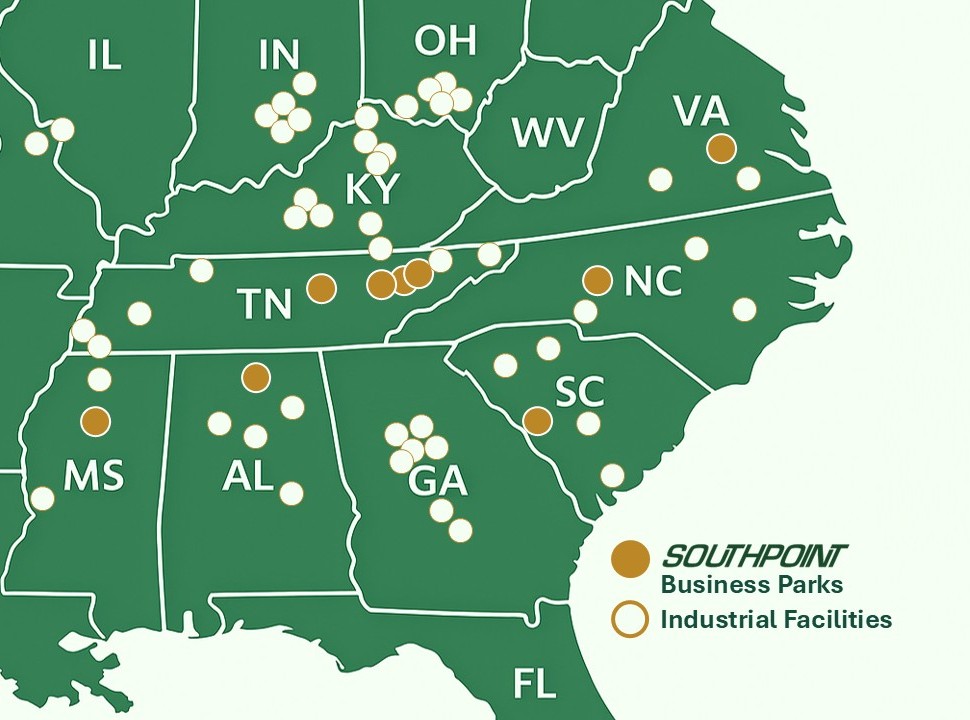

Our Southeastern Footprint

With over 50 years of experience, Hollingsworth Companies has established a significant presence across 18 states in the southeastern United States with industrial parks and properties in strategic locations.

Strategic Presence

Our extensive network of industrial properties spans across 18 states in the southeastern United States, providing strategic advantages for businesses in manufacturing, distribution, and logistics.

9 Industrial Parks

Master-planned industrial communities with premium infrastructure

200+ Properties

Ready-to-occupy buildings across multiple states

Covering 18 States

Extensive geographic reach for your business needs

Our Services

The Hollingsworth Companies offers comprehensive industrial real estate solutions to meet your business needs.

Site Selection

Strategic location analysis to find the optimal site for your industrial facility needs.

Learn MoreBuild-to-Suit

Custom industrial building solutions designed and constructed to your exact specifications.

Learn MoreSpec Available Buildings

Move-in ready industrial buildings available for immediate occupancy.

Learn MoreFeatured Available Properties

Explore our available industrial properties across 18 states.

Cost Effective, Modern Buildings

Our industrial buildings feature class A specs with high clear heights, LED lighting, and polished concrete floors. Designed for maximum efficiency and flexibility, our buildings can be customized to meet your specific operational needs.

- ✓Modern clear height ceilings for maximum storage capacity

- ✓Energy-efficient LED lighting throughout

- ✓Durable, polished concrete flooring

- ✓Customizable layout to suit your operations

Why Choose Hollingsworth

With decades of experience in industrial real estate, we deliver exceptional value to our customers.

Experience

Over 50 years of industrial real estate experience.

Quality

High-quality construction and attention to detail.

Speed

Fast-track construction to meet your timeline.

Service

Dedicated team providing exceptional service.

What Our Customers Say

Hear from businesses that have partnered with Hollingsworth Companies for their industrial real estate needs.

Joe Hollingsworth participated as one of our first equity investors. In addition, Joe Hollingsworth has served as a board member and leading advisor for strategic planning and direction.

Scott Kelley

President and CEO, Service Center Metals

I fully recommend working with The Hollingsworth Companies if cost or time driven schedules play a part in your company's opportunity because they do deliver within budget and on time with no change orders or surprises.

David B. Sutherland

CMS Companies

Latest News

View All NewsReady to Find Your Industrial Space?

Contact us today to discuss your industrial real estate needs. Our team is ready to help you find the perfect solution.